The Need for Long-Term Care

By 2030, 24 million Americans will need long-term care (LTC), nearly double the current need, but the supply of caregivers is shrinking rapidly relative to the demand.

LTC is not the long-term provision of medical care. Rather, LTC typically refers to assistance with activities of daily living (ADLs), which are routine activities people do every day to live. There are six basic ADLs: eating, bathing, getting dressed, toileting, transferring (moving from one place to another, such as from bed to chair), and continence.The ease with which individuals can perform these ADLs helps determine what type of LTC they may need. Individuals may need help with these activities from birth or after a physical or mental health decline, and they may need these services for the remainder of their life or only temporarily, such as while recovering from a medical incident.

Of course, an individual may need long-term help with many other types of activities, too, such as meal preparation, bill payment, and household chores (sometimes referred to as instrumental activities of daily living, or IADLs); while these types of services are typically not considered health care services, a caregiver may assist with these activities, as well.

Medicare

DOES NOT pay

for 'long term' nursing home care. Another good reason long term

care insurance should be part of your financial plan. The phrase "long-term care" refers to the

help that people with chronic illnesses, disabilities or other

conditions need on a daily basis over an extended period of time.

Medicare

DOES NOT pay

for 'long term' nursing home care. Another good reason long term

care insurance should be part of your financial plan. The phrase "long-term care" refers to the

help that people with chronic illnesses, disabilities or other

conditions need on a daily basis over an extended period of time.

The type of help needed can range from assistance with simple activities (such as bathing, dressing and eating) to skilled care that's provided by nurses, therapists or other professionals.

Long term care is a type of personal care service you may need if you become unable to care for yourself because of a prolonged physical illness, a disability, or a cognitive impairment, such as Alzheimer's disease.

Long term care is different from

traditional medical care that attempts to treat or cure illnesses.

Long-term care helps you maintain your current lifestyle, but it may

not improve or correct your medical problems. Care may be provided

at home or in a hospice, adult day care center, nursing home, or

assisted living facility.

Benefits of Long-Term Care

Insurance

Purchasing long-term care insurance can give you peace of mind and protect the nest egg you worked so hard to build. You'll know that if you become ill, you can afford the care you need and still have enough money in your nest egg for you and your spouse to eat. Plus, your kids won't be burdened with huge payments for your care.

The optimal age

to shop for a long-term care policy, assuming you're still in good

health and eligible for coverage, is between 60 and 65, financial

advisers say. Couples might take a look five years earlier.

Now you may be thinking: What about government programs? Can't

they help? Don't make the mistake of believing Medicare will cover

long-term care costs. It doesn't. And while Medicaid-the government

program designed for people who truly don't have any money-will

cover long-term care expenses, it should never be your first choice.

Side note: It's common for people to try to cheat the system by

moving assets out of their parent's name to get the government to

pay for LTC without touching those assets. That is considered

fraud-a federal crime-and the government will prosecute you! Don't

fall into that trap.

Unlike traditional health insurance long-term care insurance policies reimburse policyholders a daily amount (up to a pre-selected limit). Long-term care insurance can cover assisted living/memory care, adult daycare, respite care, hospice care, nursing home,and home modification to accommodate disabilities. If home care coverage is purchased the long-term care insurance can pay for needed home care often from the first day care is needed.

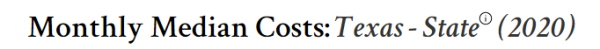

Based on annual rate divided by 12 months

(assumes 44 hours per week)

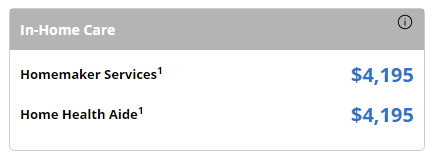

Adults Day: Based on annual rate divided by

12 months.

Assisted Living: As reported, monthly rate, private, one bedroom.

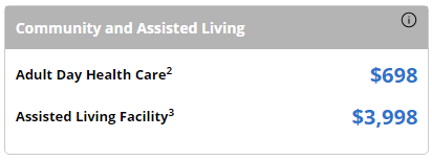

Nursing Home: Based on annual rate

divided by 12 months.

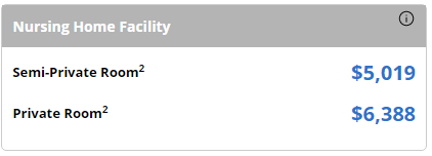

To view Genworth's Median Cost of Care in Texas

Long-Term Care Partnership

Program

Texas created the Long Term Care Partnership Program as an incentive for Texans to plan for their long-term care needs. The partnership is a joint effort between private insurers and the state. Insurers must follow state and federal guidelines to sell partnership policies.

A Texas Partnership for Long-Term

Care qualified policy provides you, as the purchaser, with

the right to apply for Medicaid under modified eligibility rules

that include a special feature called an asset disregard. This

allows you to keep assets that would otherwise not be allowed if you

need to apply, and qualify, for Medicaid in order to receive

additional long-term care services. The amount of assets Medicaid

will disregard is equal to the amount of the benefits you actually

receive under your long term care Partnership qualified policy.

Since these policies must include inflation protection, the amount

of the benefits you receive can be higher than the amount of

insurance protection you originally purchased.

* * *

If you have a Partnership-qualified long term care insurance policy and receive $200,000 in benefits, you can apply for Medicaid and, if eligible, retain $200,000 worth of assets over and above the State's Medicaid asset threshold. In most states the asset threshold is $2,000 for a single person. Asset thresholds for married couples are typically more generous.Related Articles:

- Deducting Premiums On Your Taxes

- Types of Long-Term Insurance

- What is Long-Term Care?

- The Importance Planning for Your Retirement

- Types of Long-Term Care

- Ways to Pay for Long Term Care

Home | About | Articles | Resources | Site Map | Privacy Policy

Elder Options of Texas

Copyright 2001-2024

All Rights Reserved

DISCLAIMER: Links to other websites or references to products, services or publications do not imply the endorsement or approval of such websites, products, services or publications by Elder Options of Texas. The determination of the need for senior care services and the choice of a facility is an extremely important decision. Please make your own independent investigation.