"Home Care" simply means care that does not involve nursing-type activities such as wound changes. Senior home care provides practical support with a human touch. Compassionate caregivers assist elder clients with common activities of daily living like showering, cooking and much more. Caregivers even can help with errands and transportation.

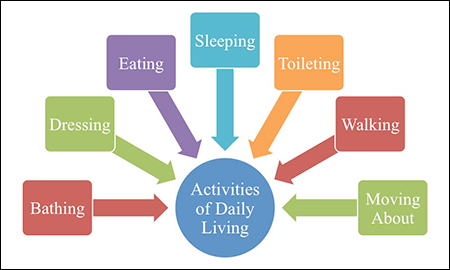

Non medical In-home care is designed to help people with Activities of Daily Living such as dressing, bathing, and meal preparation so they can continue to live in the comfort of home...things like laundry, light housekeeping, and bathing, so that you can focus on being a family rather than a caretaker or long-distance caregiver.

Activities of Daily Living (ADLs)

Benefits of Home Care

In-home care makes it possible for seniors to remain in their home

to

'age in place'

is the wish for most. And with non medical in-home care, seniors and

those with special needs, are able to do so

vs. moving to a care facility.

The following 3 min. video is a MUST WATCH to better understand how valuable non medical in-home care is to senior who wants to remain in their home...and as independent as possible. Vets can get help paying for home care through the Veterans Aid and Attendance.

According to the latest Cost of Care Survey, conducted by Genworth Financial, the median cost for home health aide services in the U.S. is $27 per hour.

By comparison, the average resident at an assisted living community pays $3,450 per month. Nursing homes can cost up to $948 per day. In the past five years, the costs for assisted living and skilled nursing have risen by 4%. Medicare doesn't cover home care.

Ways to Pay for Home Care

These include reverse mortgages, annuities, Medicare, collective sibling agreements; private insurance (covered in the next section) such as life insurance and long term care insurance; and public programs such as Medicaid and Veterans benefits.

Reverse Mortgage

Reverse mortgages were developed by the government specifically for the purpose of helping seniors (originally widows) stay in their homes until the end of their lives. With a reverse mortgage, seniors can use the value of the equity in their home to get cash now, either all at once or in monthly payments. But instead of borrowing a set sum, the loan balance increases over time. A reverse mortgage allows your loved one to stay in the home until she dies, even if by that time the loan balance exceeds the home's worth. But at that point, the home must be sold to repay the loan balance.

Annuities

Annuities are designed to help seniors turn retirement savings or a pension into a steady, guaranteed income stream that pays out until death or for a set number of years. The money can be used to pay for in-home care or, eventually, for assisted living if necessary. An annuity is like a cross between an investment fund and an insurance policy; the money is invested at a fixed or variable interest rate, and then, after an agreed-upon maturation date, you can begin making withdrawals.

Medicare Advantage Home Care Services

Beginning in 2019, for the first time, Medicare Advantage benefits include non-skilled home care services. These services include benefits such as transportation to doctors' offices or help shopping for healthier food. Some industry specialists expect that the benefit expansion may include safety improvements at home, including installation of bathroom grab bars, on top of non-skilled help with activities of daily living. The new benefits may not require a physician's prescription, but they must be designated as medically-appropriate by a licensed healthcare provider.

Long-Term Care Insurance

The first step in planning for your loved one's home care needs is to determine if he or she has Long-Term Care Insurance. Since individuals who require non-medical home care are not sick in the traditional sense, traditional health insurance, Medicare and Medicaid do not provide for their needs. Having a Long-Term Care Insurance policy in place prior to any major changes in the health and mobility of your loved one guarantees that they will have complete home care coverage assistance available if and when they need it.

Veterans Benefits

Veteran Aid & Attendance offers families and individuals an additional method of meeting home care costs. A veteran's and their spouse's joint, countable income must be less than the pension amount for which they are eligible. For example, a married veteran in 2021 is eligible for $27,549 in A&A pension; if their countable income is $10,000, then they are eligible to receive an additional $17,549 / year in pension.

Primary Home Care (PHC) Program

The Primary Home Care Program is a non-technical, medically related personal care service provided to adults whose health problems cause them to be functionally limited in performing activities of daily living, according to a statement of medical need. PHC provider agencies also provide Family Care services. This service also is a non-skilled, non-technical service provided to eligible clients who are functionally limited in performing daily activities.

In Conclusion...

Many seniors could benefit by hiring a caregiver to assist them with home care services in their home. Home care can include both professional and informal support networks such as family, neighbors, and friends. These individuals work together to meet your family's needs. Non-medical home care in particular means that caregivers do not handle skilled care like administering shots or tending wounds.

If the person only needs "non medical" home care and assistance (also known as custodial care), such as help with eating, dressing, walking, meal preparation, and housekeeping, Medicare does not cover it.

Related Articles:

Home |

About |

Articles |

Resources |

Site Map |

Privacy Policy

Elder Options of Texas

Copyright 2001-2024

All Rights Reserved

DISCLAIMER: Links to other websites or references to products, services or publications do not imply the endorsement or approval of such websites, products, services or publications by Elder Options of Texas. The determination of the need for senior care services and the choice of a facility is an extremely important decision. Please make your own independent investigation.